Carbon Border Adjustment Mechanism: What does the CBAM mean for your industry?

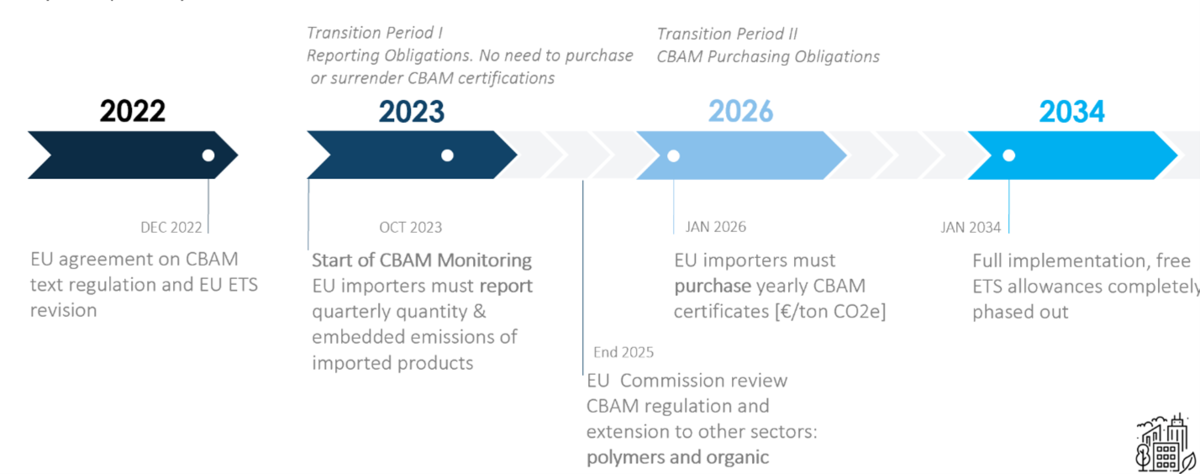

Although the official directive’s text has not yet been made public, the message from the Council of the European Union and European Parliament is clear: from October 1, 2023, a transition period for the CBAM will start and companies should start preparing for it.

Although the official directive’s text has not yet been made public, the message from the Council of the European Union and European Parliament is clear: from October 1, 2023, a transition period for the CBAM will start and companies should start preparing for it.

The creation of the CBAM is motivated by the effort to reduce greenhouse gas emissions in the EU. It targets the import of products into the EU Emission Trade System (ETS) in some of the most carbon-intensive sectors: iron and steel, cement, fertilizers, aluminum, electricity, hydrogen, and others.

The aim is twofold:

– to ensure that the price of products imported reflect their carbon impact;

– to avoid the relocation of production with high carbon emissions to non-EU countries with less-stringent regulations on climate ambitions compared to the EU.

The new regulation will gradually replace already-existing mechanisms to address the risk of carbon leakage, especially EU ETS allowances. From October 2023, a 3-year transition period begins, starting with reporting obligations only.

The CBAM’s impact on industries and supply chain:

How will CBAM influence your business?

If your company exports carbon intensive products to the EU that are included in the current draft CBAM's scope:

- Cement (kaolin and other kaolinic clays, calcined and aluminous cement)

- Electrical energy

- Fertilizers (e.g. nitric acid; ammonia, nitrates of potassium and nitrous oxide, mineral or chemical fertilizers, nitrogenous and nitrous oxide, – Mineral or chemical fertilizers)

- Iron and steel (e.g. railway or tramway track construction material of iron or steel, tubes, pipes and hollow profiles, structures and parts of structures, reservoirs, tanks, vats and similar containers, screws, bolts, nuts, coach screws and similar articles)

- Aluminium (e.g. wire aluminium, plates, bars, profiles, aluminium structures and part of structures, tanks, vats, reservoirs)

- Hydrogen

We would recommend you consider:

- The potential financial impact of CBAM on your exports (based on various scenarios)

- The potential effect on your marketing strategy

- The commercial opportunities if your products are less carbon-intensive and are “greener” than the industry average

- The preparation for greenhouse gas reporting, which might require an update or the development of GHG methodology, the development of internal processes, IT-systems for GHG accounting, product footprint tracking and CBAM reporting

The main impacts for EU importers are two:

- Pressure on less carbon-emissions

- Higher price of imported carbon-intensive goods.

These effects may lead to disruptions in the supply chain. Not just EU producers, but also their non-EU suppliers will need to focus on finding greener processes. In the short term, both could lead to higher prices of end products, making them less competitive.

Suppliers from non-EU countries should also pay attention (and we have seen signs that some primary metals associations already do) to the CBAM directive. As EU producers will be finding ways to comply with the directive, it is possible they will prefer greener EU suppliers to ensure they don’t have to pay more to get CBAM certificates.

What industries can do now

Whereas some leading companies have already started their decarbonization efforts, the CBAM will put pressure on entire industries. We are analyzing the impacts on different business fields and preparing more information.

However, suffice to say, the sooner you start taking action to tackle the effects of the new directive the better, as there is a short period of time to get prepared. The first step is, therefore, the preparation and detailed analysis of your options.

Group-IPS is ready to help you plan your actions and give advice on:

- CBAM transition pathway

- Financial impact assessment

- Assessment on methodologies, carbon footprint calculation, and how to prepare CBAM quarterly and yearly reports and declarations

- CO2e emissions reduction plan (a.k.a. energy efficiency audit)

- Decarbonization roadmap

- Energy reconversion masterplan

Our CBAM services are for both EU importers of products affected by CBAM regulation and non-EU exporters to the EU market. For a consultation on the CBAM and its potential impact on your business, please contact Maria Romero, Sustainability Process & Environment Services International Business Unit Manager.

| Maria RomeroInternational Business Unit Manager |

1 Fit for 55: reform of the EU emissions trading system (https://www.consilium.europa.eu/en/infographics/fit-for-55-eu-emissions-trading-system)